People should experience international travel at least once in their lives.

The world has so much going for it, from the variety of cultures, natural paradises, to up and coming innovations that would lead to the future. You wouldn’t want to miss most of the beautiful sites and exciting experiences each country has to offer.

But, at the same time, traveling can be quite costly. Airfare alone costs thousands of bucks, as well as accommodations, visa fees, entrance fees, and more. The list seems endless, but the rewards? Priceless.

Fortunately, for many people, there are ways to pay for traveling without their bank accounts having to suffer. One of the easiest of which is availing credit card rewards.

If you’re one to use your credit card frequently, chances are you’ll earn enough points to travel to any dream destination. But what cards should you get in order to do this? Here are the ones to look out for in 2019.

Related Top Travel Wallet

to Get for 2019

Chase Sapphire Preferred Credit Card (Visa)

Visa’s Chase Sapphire Preferred credit card is tailored for people who frequently travel. Almost all of its perks, from insurance coverage to various bonuses, are relative to travel.

By spending just $4,000 within the first three months of availing the card, you’d already earn a whopping $50,000 bonus miles that you can use for any trip. For every travel and dining purchase, you also get to earn $2 bonus points.

The Chase Sapphire Preferred card is also the best travel credit card to ensure that you’re fully covered with insurance during your trip. From cancellation fees to medical travel insurance, this card will cover all of them.

Compared to other credit cards, however, this particular Visa card does have a few drawbacks. The first of which is the annual fee. From no fee at all during the first year of purchase, it becomes $95 from the second year onwards.

That’s a pretty big leap compared to other cards, many of which don’t even contain an annual fee at all throughout the duration of use. The card also contains up to 24.99% APR on purchases and transfers, which pale in comparison to others cards that have 0% of such.

Read Be More Prepared to Travel to

Canada

with these Helpful Tips

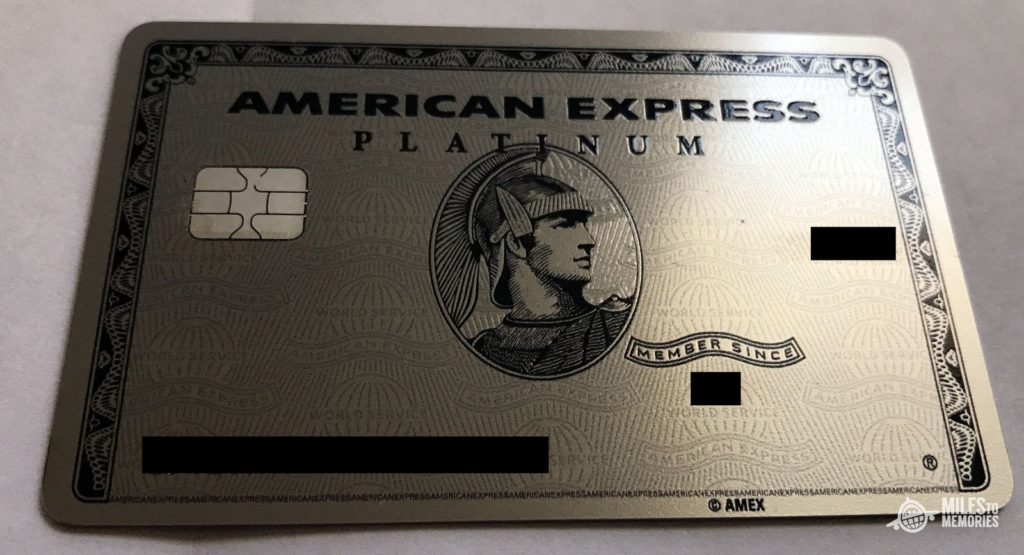

The Platinum Card (American Express)

While other cards focus on travel and dining benefits, American Express’s Platinum credit card is all about travel and shopping!

This particular card is known as a shopper’s best friend, as multiple purchases, especially in famous luxury retailers such as Saks Fifth Avenue, can earn an avalanche of benefits.

A lot of these benefits also include travel, like their annual airline fee credit of $200, easier booking for around 20 airline and hotel partners, and even $200 of Uber credits every year. Not to mention the shopping you’ll do while you’re traveling will earn several points.

Despite such overwhelming benefits perfect for any traveler, using it for other reasons can get problematic. Firstly, there’s the $550 annual fee—substiantially higher than several other credit cards that also provide the same travel benefits.

With each and every regular purchase you make with your Platinum card, you’ll only get to earn just 1 point, as compared to other cards wherein you get to earn 2 or more. By the end of the year, the points you’ve earned from your regular purchases might not even equal the $550 annual fee they require you to pay.

Read Next Airport Tips for First Time Flyers

Starwood Preferred Guest Luxury Card (American Express)

Although American Express’s Starwood Preferred Guest Luxury credit card just recently launched, it’s been getting a lot of buzzes this 2018. The card is bound to become one of the best travel rewards credit cards in 2019.

This may be because you already get to earn $75,000 in miles after spending just $3,000 during the first three months since opening your account.

You can use these points for various travel expenses, such as reserving a room at any Marriot hotel worldwide and booking discounted flights at partner airline companies. Another highlight benefit is the free luxury night stay at any partner luxury hotel and resort during each anniversary of your card membership.

As with any other credit cards in this list, the annual fees are what puts a downer in availing the Starwood Preferred Guest Luxury card. Every year, you’ll have to pay $450, which is comparatively higher than other cards.

Furthermore, similarly to the Platinum card, the Starwood Preferred Guest Luxury card is also a shopper’s card. This means that in order to avail all the wonderful travel benefits it offers, you’d have to shop till you drop. The more you purchase with the card, the better chances you have in getting all the wonderful travel benefits.

Read Next Cheapest Days to Fly to Japan

Venture Rewards Credit Card (Capital One)

If you want a card wherein you can earn double the number of miles for every purchase compared to other cards, then Capital One’s Venture credit card is the one for you.

It wasn’t named 2018’s “Best Travel Card” by CNBC for nothing! For starters, this is one of the best credit cards with travel rewards that don’t have any annual fees. You won’t have to pay a single cent for every year of membership you have with them.

After just spending $1,000 in purchases within the first three months since availing the card, you’d already earn 20,000 bonus miles, which equals to $200 travel rewards that are extremely flexible.

This card is a traveler’s dream, but can also be a nightmare for many others who’d still want the travel benefits but are not shopaholics themselves. Like the other cards on this list, the Venture credit card is one where you have to spend a lot of money in order to avail its many travel benefits. And when you redeem these rewards for cash instead, the value drops almost half than actually using them for your trip.

Additionally, unlike other credit cards, Capital One’s Venture card doesn’t have hotel partners, which means getting a free or even discounted bookings will be much more difficult.

Read Next The Best Cheap Honeymoon Destinations Around The World

Any of these great credit cards with travel rewards is your ticket to a hassle-free trip around the world. Despite having to shell out tons of money for them, the travel benefits and rewards will more than makeup for it!